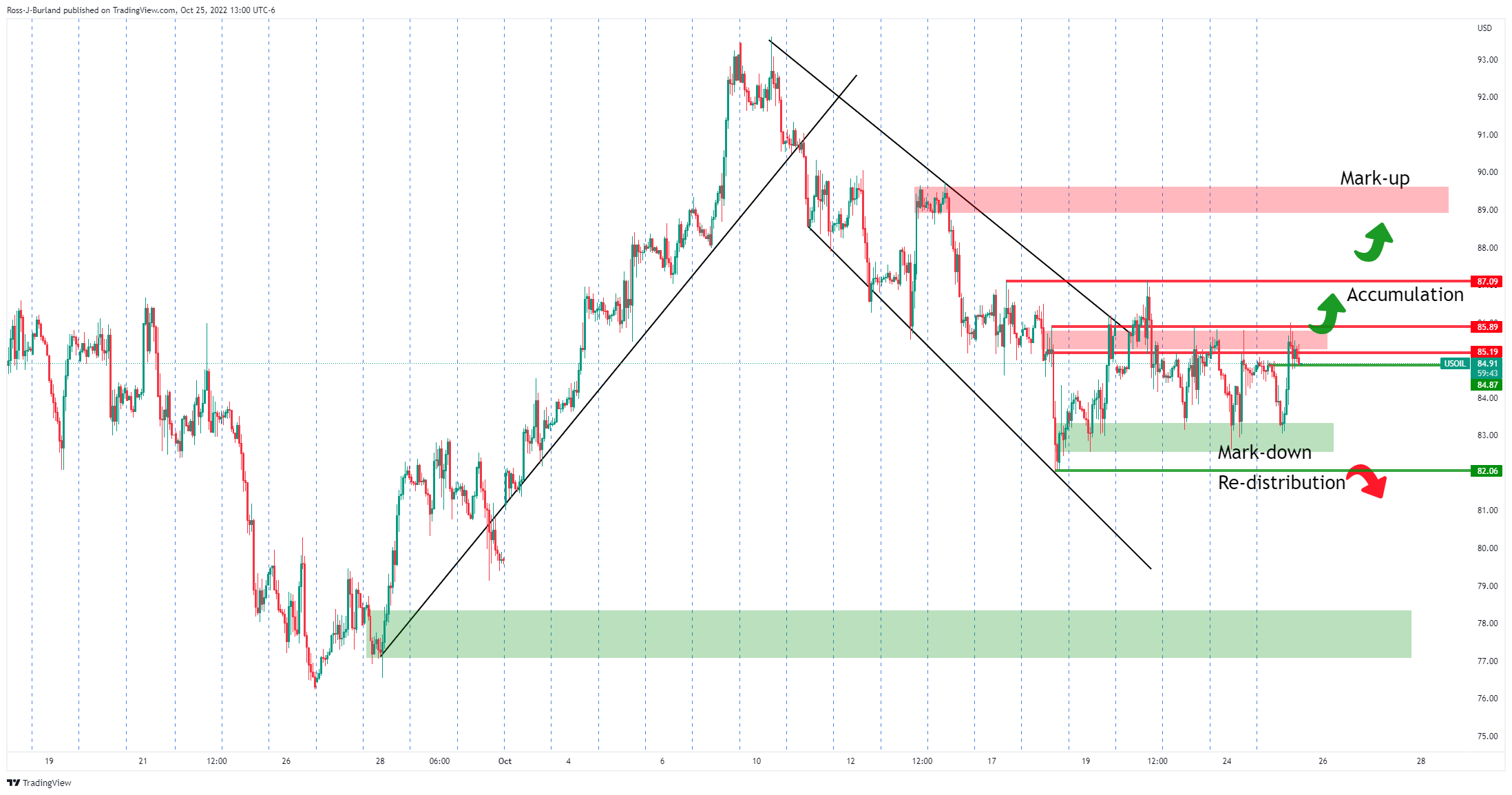

WTI sits within key territories as risk apatite lifts

- WTI bulls eye a break of key resistance on the backside of the bear channel.

- Bears will look for failures here and a move down to test prior lows of $82bbls.

West Texas Intermediate, (WTI), crude oil rose on Tuesday as US recession concerns continue, sapping up the hawkish sentiment in markets and enabling risk assets to rally. This comes ahead of production cuts next month from OPEC+ and the Federal Reserve meeting. WTI crude oil was last seen at $85bbls, trading 0.17% higher between a low of $83.08 and $86.01.

The black gold is trying to recover from the start of the week's slump that followed weak delayed economic data in China that raised concerns over demand. The third quarter Gross Domestic Demand came in at 3.9% YoY, while Retail Sales growth slowed to 2.5% in September due to the spectre of ongoing virus controls which weighed on sentiment.

''President Xi Jinping secured a third term in power and installed loyalists in the top ranks of the party. He didn’t indicate any departure from the zero-COVID strategy that has weighed on economic activity. The recent recovery in China’s oil imports faltered in September. Independent refiners failed to utilise increased quotas amid ongoing lockdowns weighing on demand. This was exacerbated by falling refinery margins and product export curbs,'' analysts at ANZ Bank explained.

However, the focus is back on the tight physical market amid ongoing supply constraints and the prospects for the implications with regard to the EU sanctions on Russian oil. Seaborne shipments from Russia fell to a five-week low in the seven days to 21 October. Meanwhile, the oil price correction came in light of better earnings reports and speculation that the monetary policy tightening cycle may be nearing its end.

US economic data released shows consumer confidence is still falling while house prices are also now dropping, indicating the monetary policy tightening may be starting to impact consumer decisions and therefore ease inflationary pressures. This in turn is stripping out the Fed narrative and pointing to an earlier pivot from the central bank, enabling risk to rally.

Nonetheless, analysts at TD Securities who noted that crude oil prices have remained range-bound since the OPEC+ group of producers announced their largest output cut since the pandemic, argue that time spreads have rallied sharply in a sign of tighter markets ahead. ''Our gauge of energy supply risk remains at its highest levels of the year, highlighting that supply risk premia are still offering an insulating force for the complex with an 'imminent Iran deal' off the table. In the imminent term, a buying program in Brent crude is expected to follow suit, after a trend following selling program was whipsawed by range-bound trading.''

WTI technical analysis

The price could be on the verge of an upside rally on a break of structure, with bulls accumulating the recent price drop. However, regardless that the price is now on the backside of the channel, the prior bullish trend's support could be regarded as the most dominant and should bulls fail to break above $87bbls, below $82 will be regarded as the mark-down level and open risks to lower prices for the foreseeable future.