GBP/USD tests into 2024’s lows near 1.2620 despite sharp revisions in unemployment figures

- GBP/USD fails to recover on upbeat macro data as US Dollar drives the market.

- UK Unemployment Rate steadies at 4.2% for the quarter ended November.

- Previous Claimant Count Change figures saw a steep revision from 16K to just 600.

The GBP/USD fell to a near-term low of 1.2620 in Tuesday trading as broader markets shrug off upbeat economic data from the UK in favor of bidding up the US Dollar (USD) across the board, sending the Pound Sterling (GBP) into the new year’s lows and putting further pressure on the pair.

Broad-market bets of a rate cut from the Bank of England (BoE) are steadying after Tuesday’ labor data print, with money markets now pricing in a total of 134 basis points in rate cut from the BoE through 2024.

The UK’s Claimant Count Change in December printed at 11.7K, the indicator’s highest print since June’s 16.2. November’s initial print of 16K was steeply revised to just 600, or 0.6K, and revisions continue to be the norm for UK jobless claims. Markets will be looking for a similarly steep revision to December’s figure at the next print.

The UK’s Unemployment Rate held steady at 4.2% for the quarter ended November, in-line with market expectations, though Average Earnings Including Bonuses slipped to 6.5% compared to the forecast decline from 7.2% to 6.8%.

The UK also had its best jobs additions figure since May, adding 73K in November compared to the previous print of 50K.

Wednesday brings another bout of UK economic figures, with the UK Consumer Price Index (CPI) for December landing alongside the UK Retail Price Index and the Producer Price Index (PPI) as the UK gets all of its inflation figures out of the way in one fell swoop.

US Retail Sales for December will also be landing later on Wednesday, which could easily knock the GBP/USD deeper if markets pile back into the Greenback.

GBP/USD Technical Levels

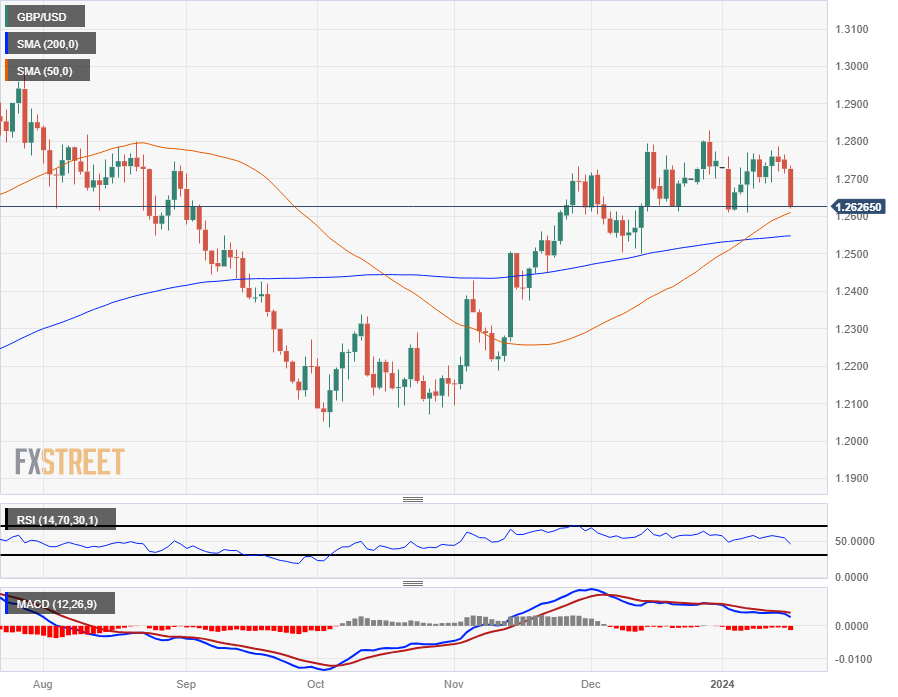

The GBP/USD fell further past the 200-hour Simple Moving Average (SMA) on Tuesday, testing into 2024’s low bids. The pair is poised for a continued drop into the 1.2600 handle, but a reversal into the top end will have to overcome a bearish crossover of the 50-hour and 200-hour SMAs in the near-term.

Looking longer-term, downside potential in the GBP/USD could be capped as the pair slides into the 50-day SMA near 1.2600, with a fresh bullish crossover of the 200-day SMA around 1.2550 pricing in a technical floor just below.

The pair is down 1.6% from the last swing high into 1.2828, but still remains up nearly 5% from October’s bottom bids near 1.2037.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Technical Levels