USD/JPY bounces off lows, bulls survive around 113.12

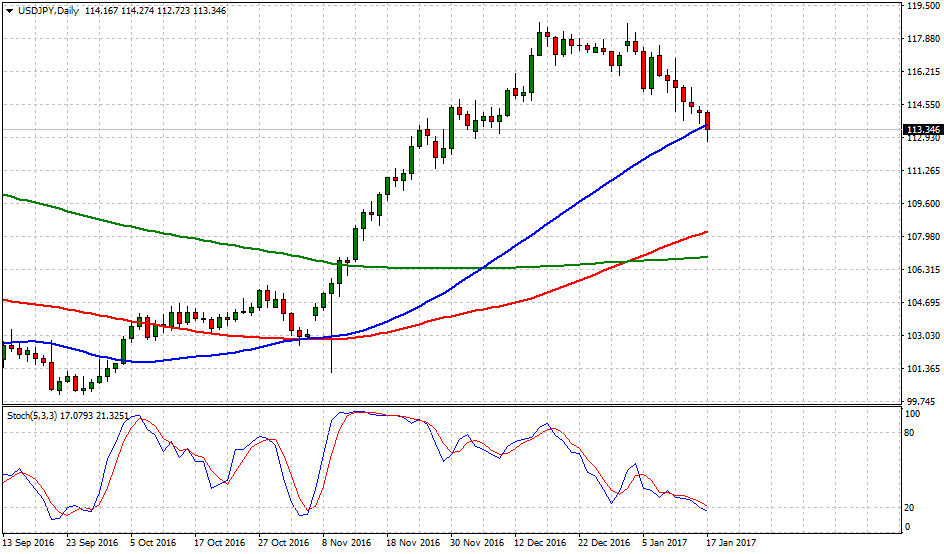

Currently, USD/JPY is trading at 113.12, down -0.90% on the day, having posted a daily high at 114.28 and low at 112.73.

When market participants were expecting the worst risk outcome, Theresa May's Global Britain and Brexit strategy plan, delivered a refreshing calm to international trade partners watching the broadcast. Furthermore, USD/JPY bulls were saved from crashing towards the psychological 112.00 mark due to a strong unity message and brighter days ahead for the UK amid the impending exit from the European Union. The expected chaos fades, at least in the short-term.

PM May's positive message; Global Britain not a dream

James Knightley, Senior Economist at ING, shares important notes from British Prime Minister Theresa May' Brexit game plan:

“She assumes that in the negotiations all participants will be “economically rational”. However, she acknowledged that some European officials may want to make an example of the UK. She stated that such actions would amount to “calamitous self-harm and not [be] the act of a friend”. In this regard she added that “no deal for Britain is better than a bad deal” and that if there was no deal, the UK can still trade (under WTO rules) and that (in a not particularly veiled threat), the UK has the freedom to set tax rates to attract foreign businesses. Moreover, not signing a deal with the UK would disrupt European supply chains and create barriers to exporting to the UK from Europe. She urged European officials not to “make Europe poorer to punish Britain”.”

Trump's Comments Send the Dollar Reeling

“In terms of the deal, she still assumes that both the divorce and the new trading environment with the EU can be agreed within the 2-year window set under Article 50. She dismissed the notion of an “unlimited transitional period”. Instead, she wants a “phased process of implementation” that would allow a “smooth and orderly Brexit”.”

USD/JPY Levels to consider

In terms of technical levels, the US dollar vs. Japanese yen recovered almost 40-pips from today's low. However, this should not be considered a scenario where bulls are back; not yet. Then, upside barriers are aligned up at 114.27 (today's high), 115.43 (Jan. 13, high) and above that at 116.85 (Jan. 11, high). While supports are aligned down at 112.73 (today's low), 111.35 (Nov. 28, low) and below that at 110.26 (Nov. 22, low).

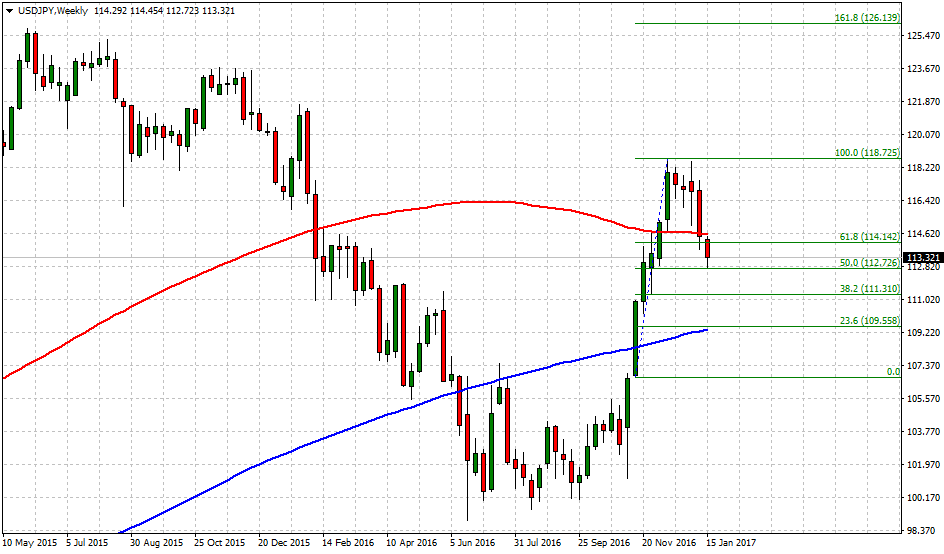

On the long-term view, bulls are trading above water after an energized Brexit speech. If in the next trading session prices do not close and open above its 100 weekly SMA, there is a bearish tone to keep playing towards 111.13 (short-term 38.2% Fib) and later, 109.55 (short-term 23.6% Fib). Without tangible actions, 118.72 seems a target far, far away for dollar bulls; not even a tweet can save those long positions anymore.

Profit taken on USD/JPY short