Crude oil WTI blasts above 2018 high amid Middle-East uncertainties

- Uncertainties about Russian and Iran sanctions keep the oil up.

- Potential supply disruption is bullish for oil.

Crude oil bulls pushed through the 2018 high at $67.76 per barrel established only 3 days ago on Friday, April 13 and WTI is now trading at 68.81 jumping 3.17% on Wednesday’s trading.

The bulls are relentlessly pressing their bets and bidding the black gold higher as investors fear that the impending sanctions on Syria, Russia, and Iran, oil producing countries, will lead to a supply disruption.

Over the last weekend, the US along with the UK and France launched an airstrike on chemical weapons’ facilities in Syria. It is still unclear what the diplomatic consequences of the attack will be and since both Russia and Iran are among the biggest oil-producing countries, an oil supply disruption could lead to even higher prices.

The agreement between the OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC countries to cut production by 1.8 million barrels a day, which started in January 2017, has almost decreased the global oil stockpiles to their five-year average. The goal of the agreement is to support oil prices.

A committee will meet on Friday in Saudi Arabia and will gauge the adherence to the cuts while in June a bigger committee will meet in order to assess if adjustments need to be made to the agreement. It has been reported that some Saudi officials are targeting $80 per barrel.

Earlier in the day, the Energy Information Administration (EIA) reported that crude oil stockpiles dropped by 1.071 million while analyst expected minus 1.429 million, which was potentially a bearish news. The market totally disregarded it and investors kept buying.

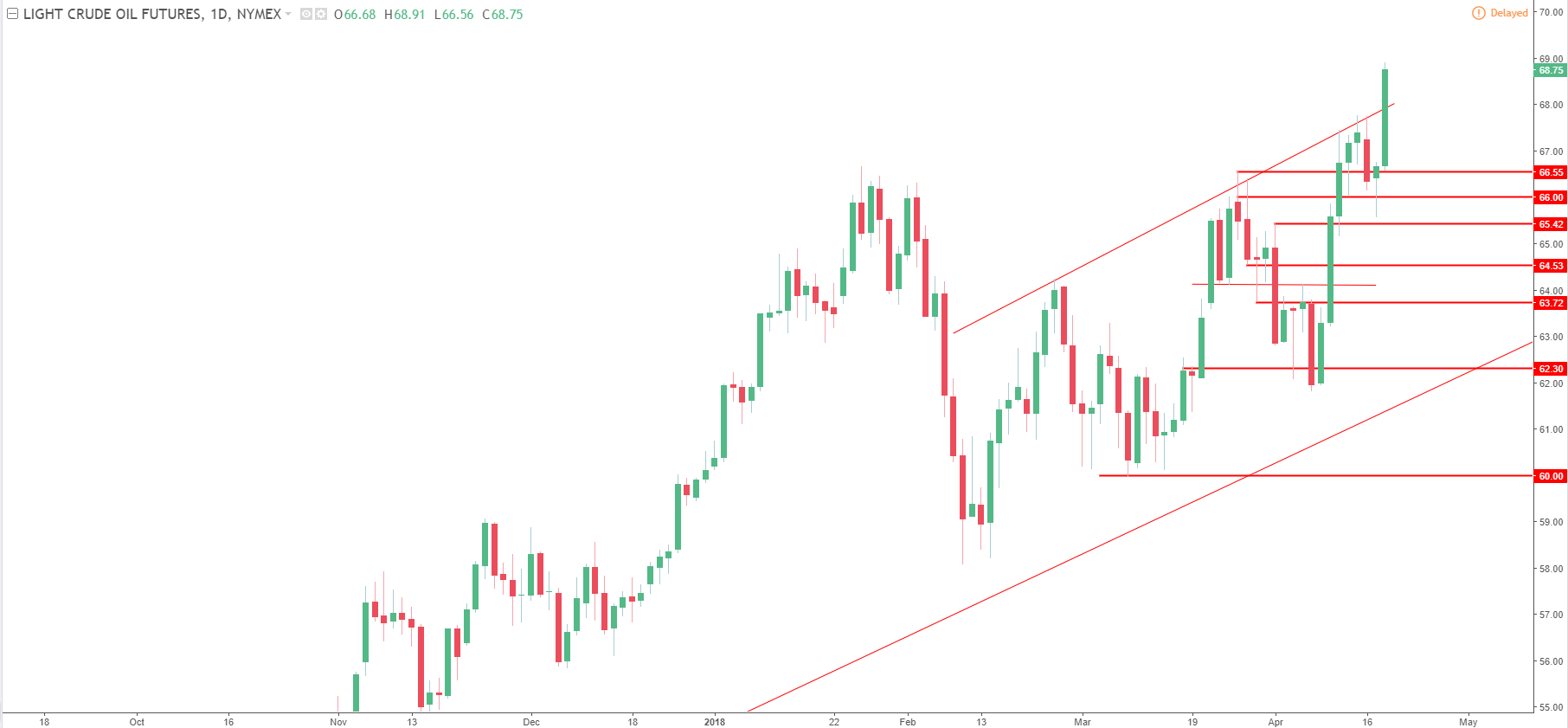

Crude oil WTI daily chart

Support is seen at 67.76 swing high an then at 66.55 swing high while resistance is the 70.00 figure.