When is the Canadian GDP report and how could it affect USD/CAD?

Canadian Monthly GDP Overview

Wednesday's economic docket highlights the release of monthly Canadian GDP growth figures for August, scheduled to be published at 1230 GMT. Consensus estimates point to a flat monthly figure, down from 0.2% growth recorded in the previous month.

According to James Knightley, Chief International Economist at ING, August GDP numbers are expected to show the economy is still close to its potential. "Our growth outlook remains upbeat, with 2.6% and 2.1% average growth predicted for 2018 and 2019 while the door for more hikes remains very much open for the Bank of Canada," he further added.

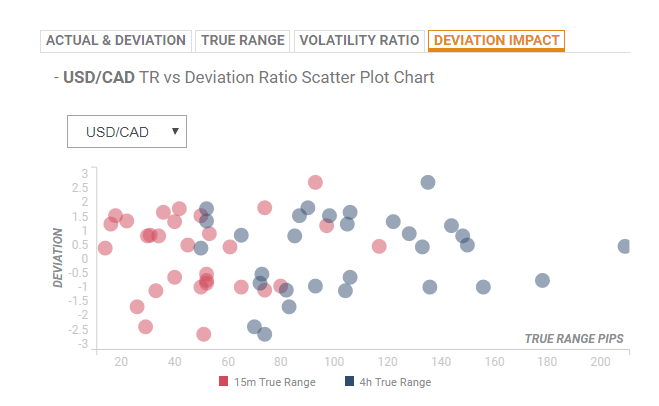

Deviation impact on USD/CAD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the pair, in case of a deviation between +0.82 to -0.82, is likely to be around 40-pips during the first 15-minutes and could get extended to 84-86 pips in the following 4-hours.

How could it affect USD/CAD?

Ahead of the key release, the pair was seen oscillating between two converging trend-lines, forming a symmetrical triangular chart pattern on the 1-hourly chart. Even a slight disappointment might be enough to provide a goodish lift and assist the pair to build on its recent positive momentum. A convincing break through mid-1.3100s will reinforce the bullish scenario and continue lifting the pair further towards reclaiming the 1.3200 round figure mark.

Alternatively, a stronger print might trigger some weakness but is more likely to find decent support near the 1.3100 handle. A convincing break through the mentioned support now seems to prompt some aggressive long-unwinding trade and accelerate the fall further towards 1.3055-50 intermediate support en-route the key 1.30 psychological mark.

Key Notes

• Canada: A solid GDP report would offer a touch of support to the Loonie - TD Securities

• Canada: August GDP to reassure economy still close to potential

• USD/CAD Technical Analysis: Forms a symmetrical triangle (bullish continuation pattern) on hourly chart

About the Canada GDP

The Gross Domestic Product released by Statistics Canada is a measure of the total value of all goods and services produced by Canada. The GDP is considered a broad measure of Canadian economic activity and health. Generally speaking, a rising trend has a positive effect on the CAD, while a falling trend is seen as negative (or bearish) for the CAD.