NZD/USD Price Analysis: How will the RBNZ affect NZD/USD?

- RBNZ in focus with a technical bias leaning to the upside for a bullish impulse.

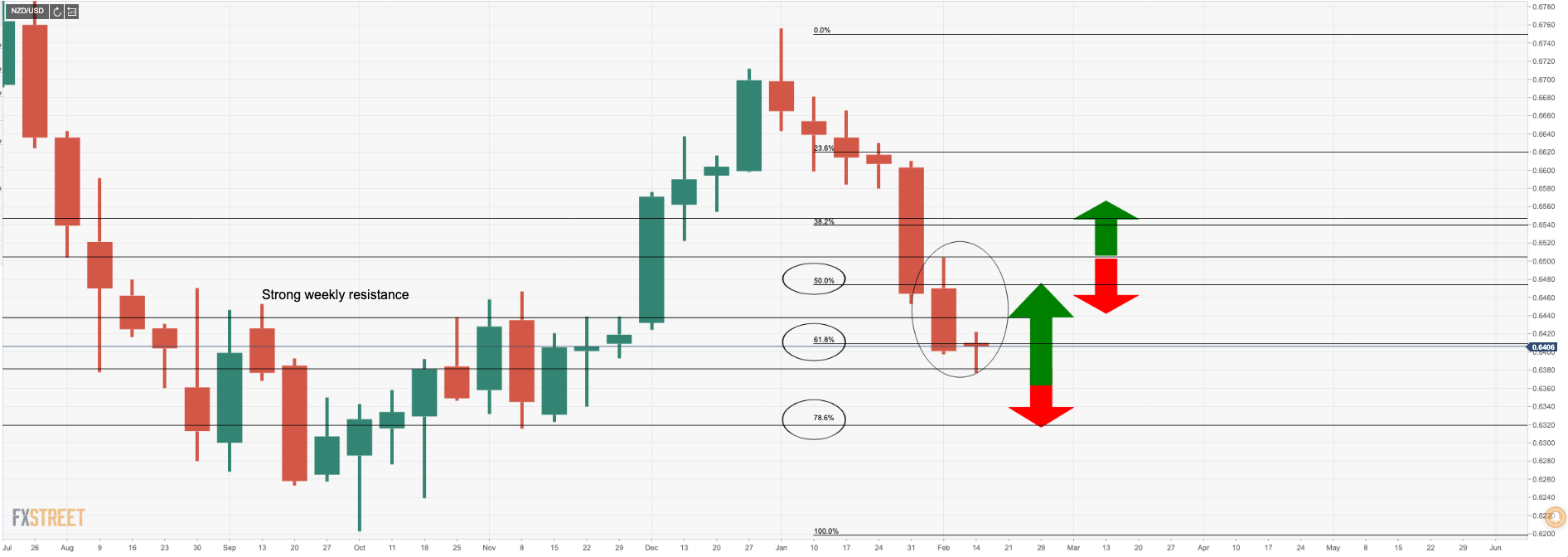

- The 61.8% golden ratio and the confluence with prior support/resistance structure is a foundation for a bullish outlook.

- The bear trend has not seen a bullish correction, yet.

- However, given the near term risks, it is an unfavourable environment for the commodity complex for which the Kiwi trades as a proxy.

- A dovish RBNZ will weigh on the bird and bears can target the 0.6320s.

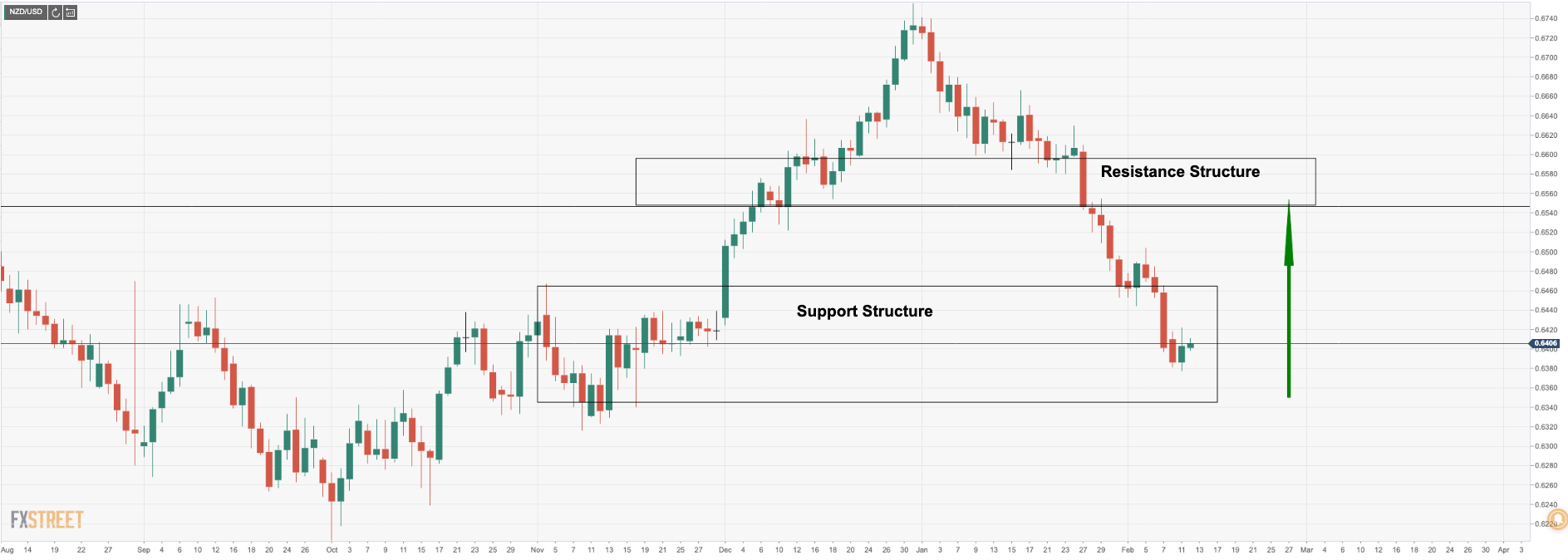

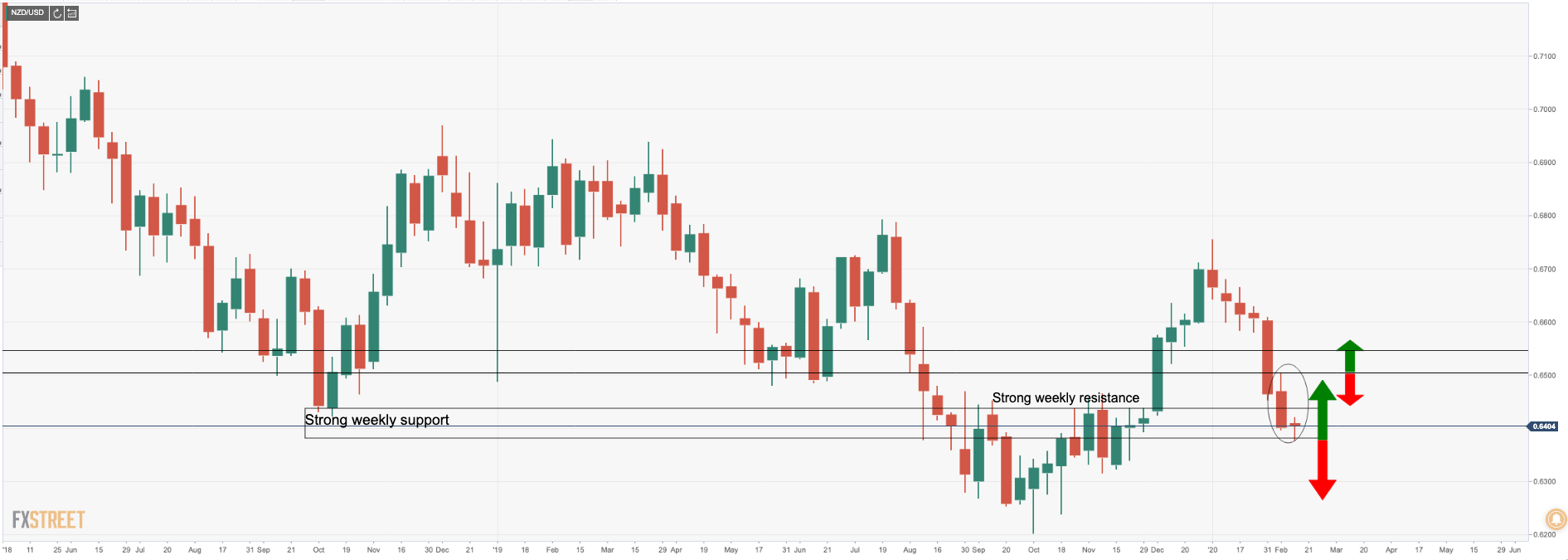

NZD/USD has been under pressure since topping out on the last trading day of 2019 up at 0.6755 in what appears to be a recovery and bottom of the 2018 downtrend. The price has completed a 61.8% retracement of the October 1st uptrend and meets the Sep-Dec resistance structure (Oct 2018 weekly support as well) which could well act as a major support structure.

- Bullish scenario: Price moves back to the 4th Feb lows and highs of 0.6449/00 which should hold an initial test. Should 0.6450 then act as a support and price bases there, the upside bias and a subsequent break of the 27th Jan lows 0.6540s and then the 0.6580s support structure (50% mean reversion confluence), then this could also start to validate the consensus for the cup and handle bottoming pattern on the daily chart of the 2018 downtrend.

- Bearish scenario: However, given the near term risks, it is an unfavourable environment for the commodity complex for which the Kiwi trades as a proxy. Should the RBNZ highlight the concerns for the coronavirus, and subsequently downgrade their OCR outlook, the 0.6320s will be in the picture, especially should the market continue buying the US dollar.

The big picture

The price is basing in a familiar support/resistance zone and while the markets do not move in a straight line, we can expect a series of waves through pivot point structures in a fresh attempt to the upside, so long as support holds.

How strong is the support structure?

As we can see, the support structure is looking rather robust, certainly worth looking for bullish entries on a correction before a possible fresh downtrend. Watch for a weekly close back above 0.6505, with a fade on rallies below back to 0.6380/00. A break below opens the 0.6230s.

Fibonaccis into consideration

The Fibos are aligned with confluences and mark key areas of interest in the market. 0.6480/00 on the upside, 0.6400 support and 0.6320 on the downside are marked areas on the Fibo-scale. Note, the 61.8% is regarded as the golden ratio and has already been achieved, so there is a corrective upside bias at this juncture for which only entries on lower time frames would be recommended. Bears will look to short on failures between 0.6470/20s, in respecting the longer-term and broader bear trend.

RBNZ expectations

Expectations are for no change in the OCR, but the skittish behaviour of the NZD reflects nervousness that the RBNZ might cut on the back of the hit to global growth stemming from the virus, which is starting to overshadow otherwise promising signs of improvement in domestic economic momentum," analysts at ANZ Bank argued, who recently downgraded their outlook for Gross Domestic Growth in 2020 for New Zealand, lowering projections to 0.8% for the first half of 2020 from 1.3%.

For a full preview of the RBNZ, see here: RBNZ Preview: Coronavirus should limit upside potential for NZD/USD