EUR/USD depressed near 1.0830 ahead of EMU data

- EUR/USD dropped and printed 2020 lows in the 1.0830/25 band.

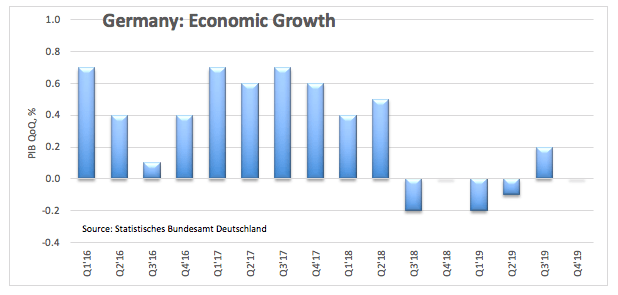

- German flash GDP came in flat QoQ in the fourth quarter.

- US Retail Sales U-Mich index coming up later in the NA session.

After bottoming out (and printing fresh 2020 lows) in the 1.0830/25 band, EUR/USD has managed to regain some poise, trim part of the daily losses and retake the 1.0840 region.

EUR/USD on the defensive post-German data

The pair is now alternating gains with losses after a briefly testing fresh yearly lows in the 1.0830/25 band.

The euro depreciated further vs. the greenback after German advanced GDP figures showed the economy is expected to come in flat during the October-December 2019 period, surprising markets to the downside (once again).

In the meantime, the spot remains well under pressure on the back of the solid pace in the buck and the resurgence of fears around the COVID-19, which has motivated investors to run away from riskier assets and funding currencies.

Later in the session, Q4 GDP figures in the broader Euroland are due along with Employment Change figures during the same period and December’s Trade Balance results.

Across the pond, the focus of attention will be on the advanced Retail Sales for the month of January and the preliminary gauge of the Consumer Sentiment for the current month.

What to look for around EUR

The pair has so far managed to bounce off YTD lows around 1.0830 at the end of the week, although the bearish mood surrounding the European currency remains far from abated. In the meantime, USD-dynamics are expected to dictate the pair’s price action for the time being along with the broad risk trends, where the COVID-19 is still in the centre of the debate. On another front, the ECB is expected to finish its “strategic review” (announced at its January meeting) by year-end, leaving speculations of any change in the monetary policy before that time pretty flat. Further out, latest results from the German and EMU dockets continue to support the view that any attempt of recovery in the region remains elusive for the time being and is expected to keep weighing on the currency.

EUR/USD levels to watch

At the moment, the pair is advancing 0.03% at 1.0842 and faces the initial hurdle at 1.0957 (weekly high Feb.10) seconded by 1.1001 (21-day SMA) and finally 1.1072 (55-day SMA). On the downside, a breach of 1.0827 (weekly/2020 low Feb.14) would target 1.0814 (78.6% Fibo of the 2017-2018 rally) en route to 1.0569 (monthly low Apr.10 2017).