NZD/USD sits at daily resistance ahead of RBA & NFP

- NZD/USD now awaits the RBA and the NFP report.

- US dollar is attempting to move higher on hawkish Fed speakers.

At the time of writing, NZD/USD is making tracks to the upside and 0.22% higher at the close of Wall Street.

NZD/USD is trading near 0.7050 after climbing from a low of 0.7036 earlier in the day to score a fresh breakout high of 0.7073 in what is a period of accumulation on the weekly time frame, see below.

Meanwhile, it was a stronger session on Wall Street for US stocks on robust initial and continuing jobless claims in the US.

However, the improvement in data has also gone to serve the US dollar bulls on Thursday ahead of the main event in today's Nonfarm Payrolls in Friday's US session.

NFP could go either way for USD

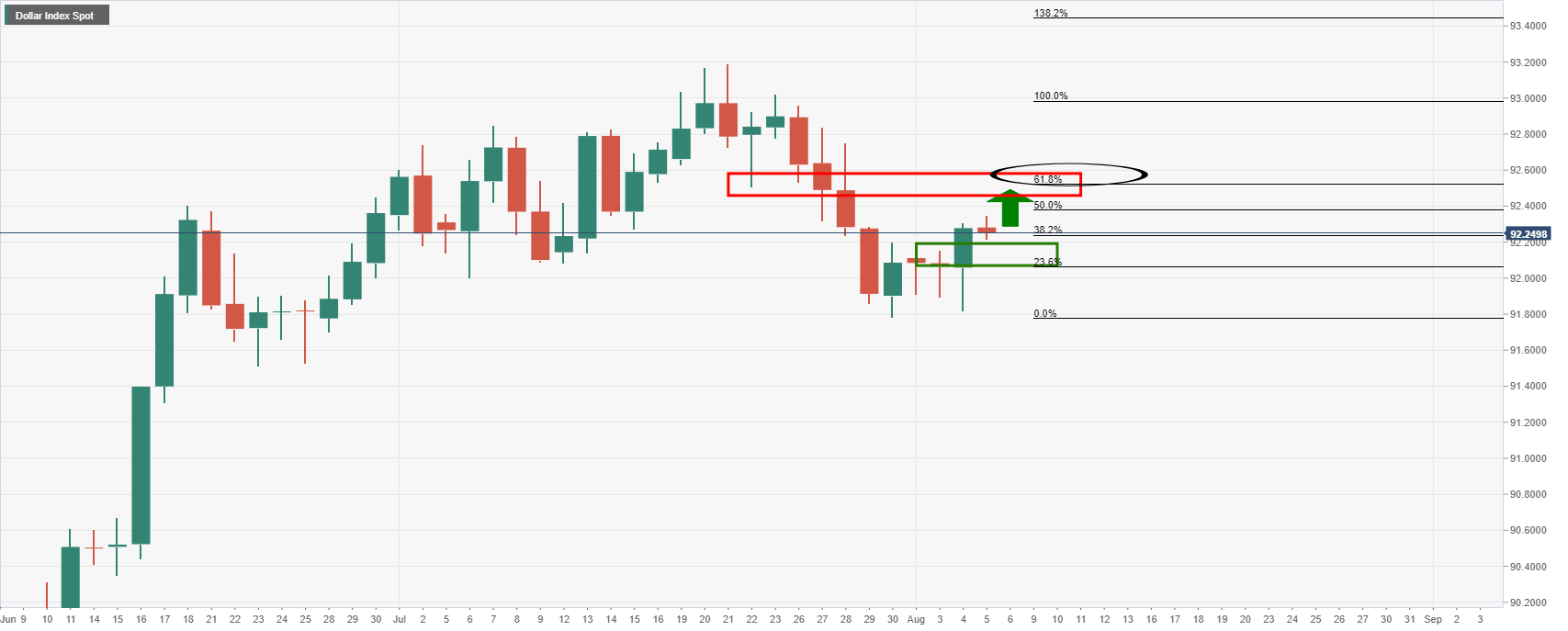

The chart above illustrates the current bullish trajectory in the US dollar, DXY index where the price would be expected to travel to on a bullish outcome from the NFP on Friday and clip the wings of the bird, see below.

On the other hand, there is potential for a disappointment in contrast to the current hawkish narrative from the Federal Reserve.

In such a scenario, this would be expected to hurt the greenback and potentially send it over the cliff into the abyss to test the 90.50/40s area:

''The market's question of how quickly the RBNZ can hike while other central banks stand pat does suggest that there’s a lot of good news priced in already, and that’s a headwind for the Kiwi,'' analysts at ANZ bank argued.

''Expect range-trading today ahead of key US jobs data tonight, which will shape market views of Fed policy.''

NZD/USD technical analysis

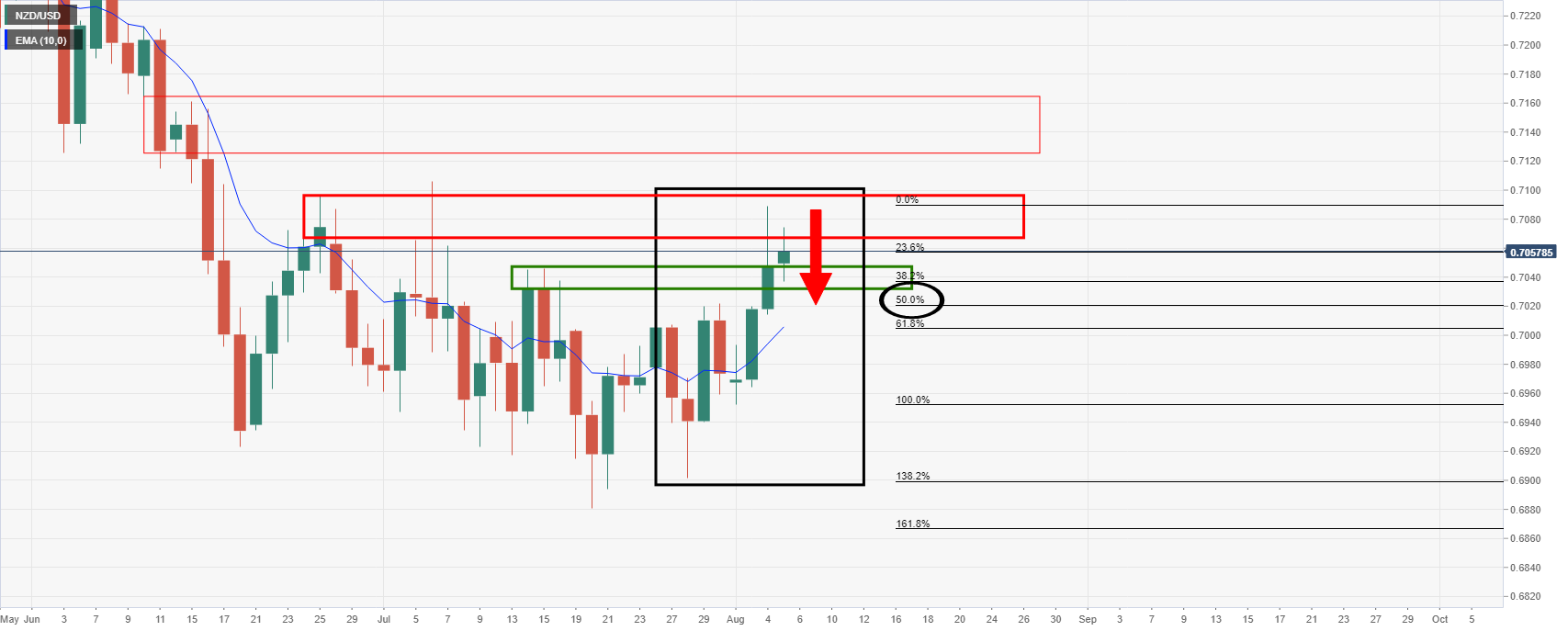

Meanwhile, the bird has been in a phase of accumulation and is attempting a breakout to the upside:

However, the upside is marred by not only near term resistance but also the W-formation which is a reversion pattern where the price would be expected to be hamstrung to the neckline. (The 50% mean reversion level is aligned there currently).

In the case of an overextended pattern, such as NZD's current, a correction to the 38.2% Fibo is a higher probability, especially if hs a confluence of old resistance that would be expected to act as support.