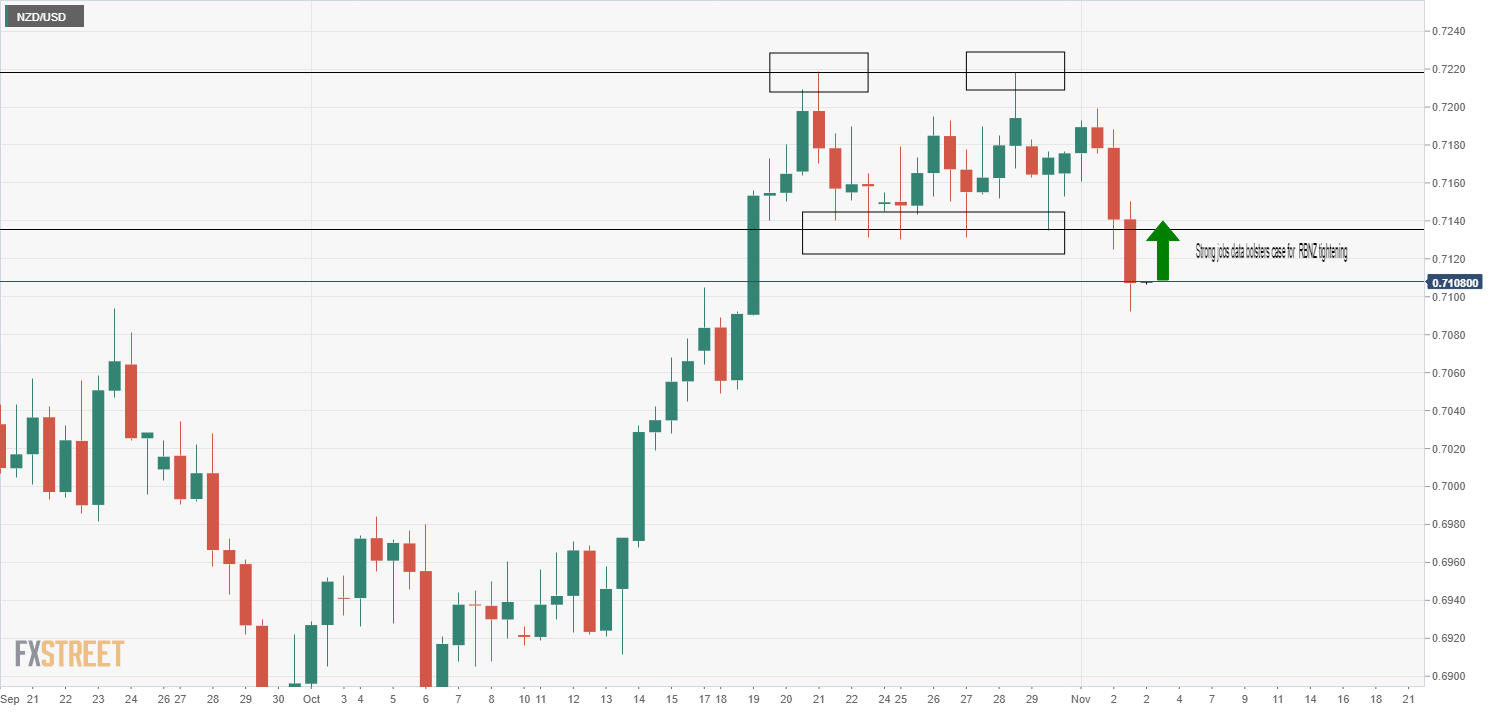

NZD/USD slips below key support, consolidates at 200DMA ahead of key NZ jobs report

- NZD/USD has dropped sharply on Tuesday from the upper 0.7100s to the 200DMA at 0.7100.

- If New Zealand Q3 jobs data, set for release shortly, is strong, the pair could retest prior support at 0.7130.

The New Zealand dollar has seen significant selling pressure on Tuesday, with the currency seemingly being dragged lower in tandem with its cross Tasman sea peer the Aussie; AUD has been selling off in wake of Tuesday’s Asia Pacific session RBA meeting, at which RBA Governor Philip Lowe delivered a stronger than an expected dose of pushback against hawkish money market pricing than markets had likely been expecting (he criticised the notion of rates being hike as soon as 2022), though the RBA did admittedly open the door to a potential first rate hike in 2023. Either way, AUDUSD is down about 1.2% on the day and, subsequently, NZDUSD is down about 1.0%.

Whilst it is normal to expect AUD underperformance to exert some drag on the highly correlated NZD, the extent of the sell-off in NZD on Tuesday has been somewhat perplexing. Technical selling, once the pair dropped below key resistance in the 0.7130 area, will have exacerbated things (perhaps a few stops were blown through). The pair now trades around the 0.7100 level, which also coincides with its 200-day moving average, marking a roughly 100 pip turnaround from last week’s highs above 0.7200.

Key NZ jobs data set for release at 2145GMT

Perhaps some pre-positioning ahead of the release of very important New Zealand economic data has also been at play; at 2145GMT, Q3 labour market data is released. In Q2, the Household Labour Force Survey unemployment rate stood at 4.0%, a level the RBNZ deems as consistent with full employment and a key justification (alongside above-target inflation for the same quarter) for starting off their rate hiking cycle in October. Some local banks are calling for the unemployment rate to drop under 4.0% in Q3, which would take it to its lowest level since 2008 (prior to the global financial crisis). Such an outturn would strengthen the case for the RBNZ to lift rates swiftly in order to mitigate upside inflation risks and would support NZD/USD, perhaps allowing it to recover and retest prior support (now resistance) around 0.7130. NZD traders will also keep an eye on alternative labour market indicators such as the Participation Rate (expected to fall a little due to the lockdowns in New Zealand in Q3) and the Labour Cost Index.

Note that the RBNZ will also be releasing its Financial Stability Report at 2000BST, where high housing costs and the associated implications will be a key theme. With the RBNZ already on the path towards acting decisively to lift rates, this report will likely not garner too much attention now more kiwi dollar markets too much.